- TraderTV Research

- Posts

- Trader TV Watchlist - February 7, 2025

Trader TV Watchlist - February 7, 2025

Friday February 7, 2025

Welcome to the TraderTV Live Morning Research Note. Here's what's making major moves in the market today.

TraderTV.LIVE™ features a daily live trading broadcast, professional education and an active community of more than 450,000 subscribers. Join us on YouTube every weekday from 8:30am to 4:30pm EST for the first and only professional trading show on YouTube Live!

Economic Events:

0830 - Nonfarm payrolls for January: Expected 175k; Prior 256k

0830 - Unemployment rate for January: Expected 4.1%; Prior 4.1%

0840 - Fed’s Kashkari speaks

0925 - Fed’s Bowman speaks

1000 - Michigan consumer sentiment for February: Expected 71.8; Prior 71

1000 - Michigan 5yr inflation expectations for February: Expected 3.2%; Prior 3.2%

1200 - Fed’s Kugler speaks

Premarket Trading:

Trading Higher ($): BABA, PINS, AFRM

Trading Lower ($): ELF, AMZN, BILL

Earnings Today:

Premarket: CGC, FTV, AVTR

In The News

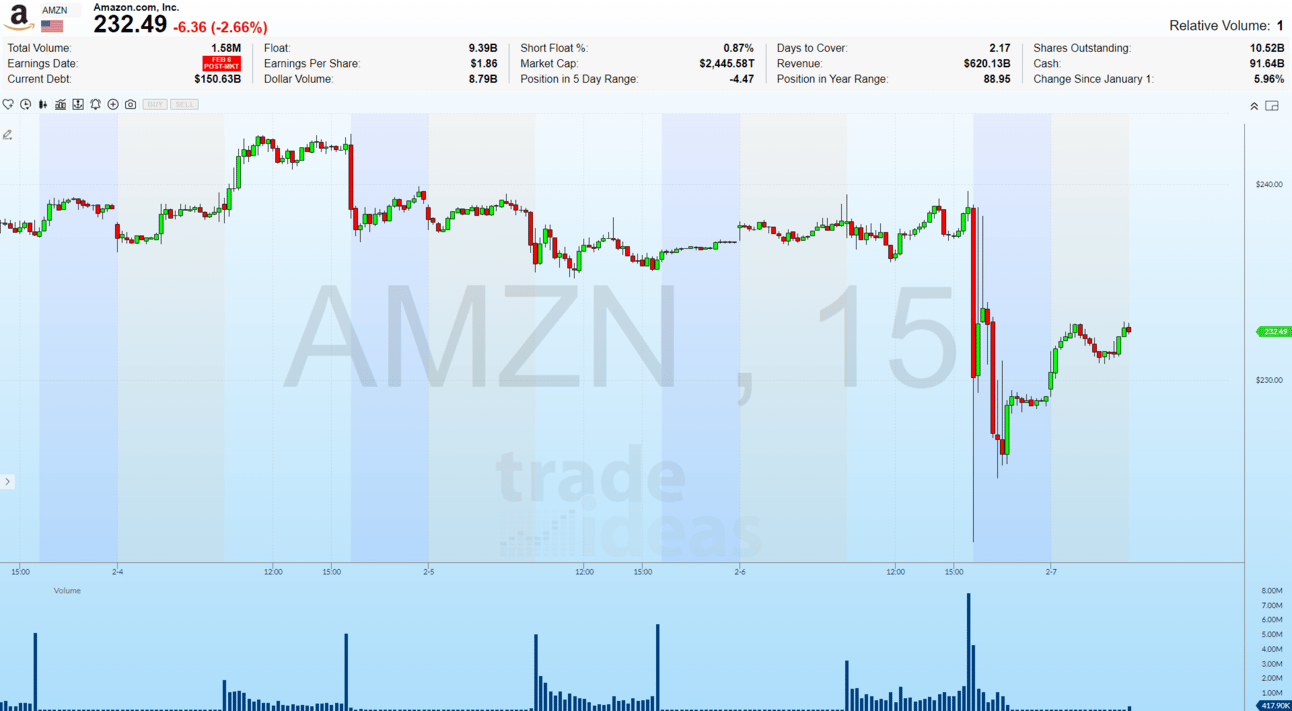

Amazon.com Inc (AMZN)

-3.02%

Trading lower after beat earnings and revenue expectations for Q4, reporting $1.86 EPS (vs. $1.49 expected) and $187.79B in revenue (vs. $187.30B expected). However, its weaker-than-expected guidance for the current quarter—$151B-$155.5B in sales (vs. $158.5B expected)—caused the stock to drop over 5% in extended trading. The company cited a $2.1B foreign exchange headwind as a key factor in the lower outlook. They also announced they expect to boost Cap Ex Spend to $100B in 2025 as AI investments continue.

Tesla Inc (TSLA)

-0.94%

The company’s China sales fell 11.5% YoY in January to 63,238 units as domestic competition intensified. Sales for rival BYD surged 47% YoY with 296,446 EV and hybrid sales. Investors await a new affordable model in 1H 2025 to reinvigorate demand. Meanwhile, Tesla aims to roll out its Full Self-Driving (FSD) system in China this year.

Pinterest Inc (PINS)

+20.30%

Gapping up after its earnings report. The company reported adjusted earnings of $0.56 per share, below estimates of $0.65, but sales of $1.15 billion beat estimates of $1.139 billion. Revenue rose 18% year-over-year, with global monthly active users increasing by 11%. The company guided Q1 revenue between $837 million and $852 million, above estimates of $832.77 million, and projected adjusted EBITDA between $155 million and $170 million.

Affirm Holdings Inc (AFRM)

+14.66%

Gapping up after its Q2 2025 earnings report, with GAAP earnings of $0.23 per share exceeding an estimated loss of $0.16 and sales of $836.38 million beating estimates of $807.16 million. The company reported a 35% year-over-year increase in gross merchandise volume and a 23% increase in active consumers. Transactions per consumer rose from 4.5 to 5.3 on a year-over-year basis. For fiscal 2025, Affirm guided revenue between $3.13 billion and $3.19 billion, above estimates of $3.09 billion.

Chinese ADRs

+1.71%

Trading higher as a group as Chinese tech names continue to benefit from renewed optimism around the space. China's growing influence in artificial intelligence has pushed the Hang Seng Tech Index into a bull market, with major players like Xiaomi and Alibaba surging nearly 30% since January. The emergence of DeepSeek’s AI model as a potential game-changer underscores China's innovation, prompting a reassessment of its undervalued stocks despite ongoing geopolitical tensions.

BABA, BILI, PD, JD, BIDU, LI, NIO, XPEV, ZK, FXI, KWEB

Meta Platforms and Alphabet Inc

+0.30%

On watch as President Donald Trump’s 75-day timeframe for the sale of TikTok, which began in January 20, slowly elapses. Short-form video platforms like Meta’s Instagram and Google’s YouTube Shorts stand to benefit from TikTok’s expulsion from the US. On Friday morning, Punchbowl News reported that Vice President JD Vance and Michael Waltz, National Security Advisor, were asked by Trump to oversee a possible TikTok sale. This follows reports from Bloomberg suggesting that YouTube is buying TikTok ads so that creators can be inspired to move over to their platform.

META, GOOGL

e.l.f. Beauty Inc (ELF)

-26.29%

Gapping down following its Q3 2025 earnings report. The company reported in-line earnings of $0.74 per share and sales of $355.32 million, above estimates of $329.573 million. Net sales grew by 31% year-over-year and its gross margin grew by roughly 40 basis points. e.l.f. guided earnings of $3.27 to $3.32 per share for fiscal 2025, below estimates of $3.54, and projected revenue of $1.3 to $1.31 billion for the same period, missing estimates of $1.337 billion. UBS and Morgan Stanley downgraded the stock following the report.

BILL Holdings Inc (BILL)

-28.85%

Gapping down following its Q2 2025 earnings report. The company posted adjusted earnings of $0.56 per share and sales of $362.55 million, beating estimates of $0.46 and $360.23 million, respectively. BILL provided higher-than-expected quarterly EPS guidance but lower-than-expected revenue guidance for Q3 2025. The company also raised its revenue and EPS guidance for fiscal 2025, though the lower end of its revenue guide still falls below analyst estimates of $1.46 billion.

Canopy Growth Corp (CGC)

-19.03%

Gapping down following its earnings report, leading to a drop in other cannabis-related stocks in sympathy. The company’s Q3 2025 revenue dropped by 5% year-over year, and its gross margin contracted by 400 basis points over the same period. Despite the year-over-year decline, Canopy’s revenue of 74.76 million CAD still beat estimates of 69.11 million CAD. Canopy also reported losses of 1.11 CAD per share, outpacing analyst estimates.

Lottery.com Inc (LTRY)

+25.53%

Continuing to trade higher premarket with volume. On Tuesday, February 4, the company announced that it is launching international lottery operations and is aiming to expand into emerging markets like Europe and Africa. The stock has a float of 3.54 million shares, approximately 5.1% of which are sold short.